Table of Contents

Production costs of PBF technologies for polymer materials

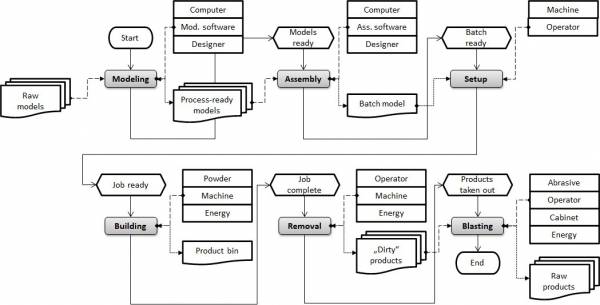

The activity-based PBF production model for manufacturing of polymer products described in the section "Costs of PBF technologies" is presented in the following picture:

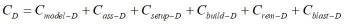

The total costs of the process may be expressed as a sum of costs for each of the activities, when the cost of an activity may be determined by analysis of the categories of costs for each of the activities.

The total costs of the process may be expressed as a sum of costs for each of the activities, when the cost of an activity may be determined by analysis of the categories of costs for each of the activities.

The other possibility, which is presented here is to analyze each of the cost categories for each of the activities.

Total costs

Direct production costs

As explained, the direct production costs may be expressed as a sum of direct costs of all activities (index model stands for modelling, ass for assembly, setup for setup, build for building, rem for removal and blast for blasting activity).

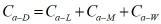

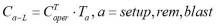

For each of the activities (denoted by a), the the direct cost may be expressed as a sum of labour costs (index L), material costs (index M), and energy costs (index W) as

For each of the activities (denoted by a), the the direct cost may be expressed as a sum of labour costs (index L), material costs (index M), and energy costs (index W) as

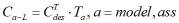

Labour costs

The labour costs of each of the activities can be separated into the designer costs and operator costs. Designer costs are the cost of the work of engineers, which are typically higher than the cost of the work of operators, and they are arising in the phases of modelling and assembly. The designer labour costs can be expressed as a product of the hourly rate paid to designers (CTdes) and the time for the specific operation activity (Ta), which may be modelling or assembly.

Operator costs arise in the phases of preparation, removal and blasting, and may be expressed in a similar way just using the time unit costs of the labour of operators (CToper).

Operator costs arise in the phases of preparation, removal and blasting, and may be expressed in a similar way just using the time unit costs of the labour of operators (CToper).

Material costs

Material costs arise during the building and blasting activities. The material costs of building comprise powder costs, and in the case of MJF technology, the costs of fusion agent and detailing agent. The blasting material costs comprise the costs of abrasive that is used during the blasting.

The crucial fact in analysis of material costs of building activity is that the material, which is used in the powder bed fusion technologies, is really a mixture of virgin (fresh) powder and the powder that was used, but not sintered, during the previous production processes. The latter powder is still usable, but its properties are changed to some extent - so it has to be mixed with virgin powder to form the production powder mixture. The ratio between the masses of the virgin powder and the total mass of production powder is the refreshment rate r, and it depends on the material that is used, being 50-75%. Therefore, only a part of the consumed powder represents virgin powder, which is the material cost of the building process. Since the amounts of used powder are always (and more than) sufficient to make the production mixture, it comes with no cost. One may as well say that the material cost of the used powder was taken into account when it was virgin powder, in some of the previous building processes.

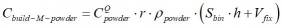

The material costs in the building process consist of two parts: fixed consumption and the variable consumption. The fixed consumption represents the powder around the production bin in production chamber. That amount depends on the production machine, and it does not depend on the composition of a batch. On the other hand, the variable consumption is the part of consumption that depends on the composition and volume of the batch, essentially being proportional to the height of the batch h. The costs of building powder may be calculated by multiplying the unit cost of the mass of the powder (CQpowder) with the consumed mass of fresh powder, which is only a part of the total mass of the powder in the production bin that is the product of the density of the powder (ρpowder) and the volume of the powder in the production bin. That volume consists of the fixed volume of the powder around production bin (Vfix) and the variable volume of powder in the production bin, which is equal to the product of the cross-section of the production bin (Sbin) and the height of the production batch.

The previous expression reveals the critical role that the the height of a batch plays for material costs, which are quite high in PBF technologies. The height of the batch depends on the spatial distribution of the products in a batch. That height depends on the assembly designer skills, but the work of the assembly designer has to follow the rules about the distances between parts, to take care about the anisotropy of accuracy of the production process. On the other hand, the height of a batch is affected by the number and dimensions of its products.

The previous expression reveals the critical role that the the height of a batch plays for material costs, which are quite high in PBF technologies. The height of the batch depends on the spatial distribution of the products in a batch. That height depends on the assembly designer skills, but the work of the assembly designer has to follow the rules about the distances between parts, to take care about the anisotropy of accuracy of the production process. On the other hand, the height of a batch is affected by the number and dimensions of its products.

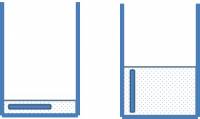

The importance of the height for the material costs of a batch is one of the reasons why the usual concepts about the costs of a product may not be applied to costs of PBF technologies. In the example presented in the following figure is assumed that only one product should be manufactured and that the product is a bar that has a high aspect ratio (with length being much longer than the diameter). Therefore, if the product is manufactured with the horizontal orientation, as presented on the picture on the left side, the total height of the production batch will be small. However, if, for the reasons of accuracy the product has to be manufactured in the vertical orientation, as shown in the figure on the right side, then the height of the production batch, and the related variable material costs, will be much higher than in the first case. This example demonstrated why a product may have different costs in different production batches, and why a production cost of a single product is not a meaningful concept in PBF technologies.

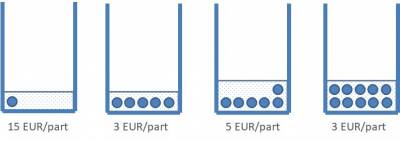

The example on the figure below explains why dependence of the material consumption on height prevents application of another concept known from traditional production technologies, that an increase of the number of products reduces costs per product. In the example is assumed that the product is the same bar as previously, and that the variable material costs for production of one bar in horizontal direction is 15 EUR, as shown if the first figure from left, which shows only the cross-section of the bar. If five bars may be arranged in the same row, than the variable material cost drops to 3 EUR per part. However, if six bars should be produced, the sixth bar has to be produced in the second row, and the variable material costs rise to 30 EUR, so that the variable unit cost rises to 6 EUR per product, as shown in the third image from left. The fourth image from left shows that the minimal unit cost of the bar in 3 EUR per product, and that the variable material costs cannot be further reduced after number of products increases above five.

The example on the figure below explains why dependence of the material consumption on height prevents application of another concept known from traditional production technologies, that an increase of the number of products reduces costs per product. In the example is assumed that the product is the same bar as previously, and that the variable material costs for production of one bar in horizontal direction is 15 EUR, as shown if the first figure from left, which shows only the cross-section of the bar. If five bars may be arranged in the same row, than the variable material cost drops to 3 EUR per part. However, if six bars should be produced, the sixth bar has to be produced in the second row, and the variable material costs rise to 30 EUR, so that the variable unit cost rises to 6 EUR per product, as shown in the third image from left. The fourth image from left shows that the minimal unit cost of the bar in 3 EUR per product, and that the variable material costs cannot be further reduced after number of products increases above five.

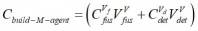

The manufacturer of the MJF equipment declares that the consumption of both fusion and detailing agents is proportional to the volume of the products. Therefore, the material costs of the agents (Cbuild-M-agent) may be calculated using the agent consumptions per unit volume of products (VVfus and VVdet) and the unit costs per volume of the agent (CVfus and CVdet) for the fusion and the detailing agents:

The material costs of the blasting may be calculated as the product of the weight unit costs of the abrasive material (CQabras) and the weight of the used abrasive, which may be estimated as the product of the time unit consumption of the abrasive by the blasting cabinet (QTcab) and the duration of blasting (Tblast):

Energy costs

Since the electric power of machines is orders of magnitude higher than electric power of computers, energy costs of the modeling and batch activities will be calculated only through the indirect infrastructure costs. The energy costs of the setup, building and removal activities may be calculated using the costs of energy unit (CkWhW).

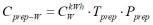

Setup energy costs (Csetup-W) are practically always the same because the operations that need to be done are almost always the same. Thus the energy costs of the setup activity are fixed energy costs, and they may be calculated by multiplying the unit costs of energy with the time for preparation of the machine (Tsetup) and the power of the machine during the preparation phase (Psetup).

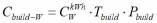

The building energy costs (Cbuild-W), on the other hand, depend on duration of the process, which, in turn, depends on the height of a batch, but also on a spatial distribution of the products in a batch. If lot of the space within the production chamber is occupied by the products, the sintering process is going to last longer than if there is a lot of empty spaces between the products. The building energy costs may be calculated using the duration of the building (Tbuild) and the power of the machine in the building phase (Pbuild).

The building energy costs (Cbuild-W), on the other hand, depend on duration of the process, which, in turn, depends on the height of a batch, but also on a spatial distribution of the products in a batch. If lot of the space within the production chamber is occupied by the products, the sintering process is going to last longer than if there is a lot of empty spaces between the products. The building energy costs may be calculated using the duration of the building (Tbuild) and the power of the machine in the building phase (Pbuild).

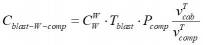

The consumption of energy, and the energy costs, of the blasting activity (Cblast-W) has to take into account not only the energy costs due to the consumption of the blasting cabinet (Cblast-W-cab),but also the energy consumption of the air compressor (Cblast-W-comp), which has much higher electric power. The energy cost of the blasting cabinet is the product may be calculated using the duration of the blasting (Tblast) and the power of the machine in the blasting phase (Pblast)

The consumption of energy, and the energy costs, of the blasting activity (Cblast-W) has to take into account not only the energy costs due to the consumption of the blasting cabinet (Cblast-W-cab),but also the energy consumption of the air compressor (Cblast-W-comp), which has much higher electric power. The energy cost of the blasting cabinet is the product may be calculated using the duration of the blasting (Tblast) and the power of the machine in the blasting phase (Pblast)

However, an air compressor usually supplies several pressurized air consumers, so that only a part of the energy consumption of the air compressor may be attributed to the blasting activity. If the electric power of the air compressor is (Pcomp), the air flow capacity of the compressor per unit time is vTcomp, and the air flow consumption per unit time of the blasting cabinet is vTcab, then the energy consumption of the air compressor is

However, an air compressor usually supplies several pressurized air consumers, so that only a part of the energy consumption of the air compressor may be attributed to the blasting activity. If the electric power of the air compressor is (Pcomp), the air flow capacity of the compressor per unit time is vTcomp, and the air flow consumption per unit time of the blasting cabinet is vTcab, then the energy consumption of the air compressor is

Indirect costs

The indirect costs are shared between different production jobs. Based on their connection to the activities in the event-driven process chain, two kinds of the indirect costs may be distinguished. To the first kind belong the equipment costs (CE), which are connected to specific activities in the event-driven process chain, but are shared between different production jobs. On the other hand, the overheads costs (Cover) and the other indirect costs (CX) are not connected to any of the activities. Therefore, the complete indirect costs attributed to a production batch may be expressed as

It should be noted that the indirect production costs are exceptionally high for all additive manufacturing technologies, and thus it is very important to be calculate them as well.

It should be noted that the indirect production costs are exceptionally high for all additive manufacturing technologies, and thus it is very important to be calculate them as well.

Equipment costs

The equipment costs can be divided into the machine costs, software costs and consumables. The usual way to express the equipment cost is to calculate their time unit costs because later the total costs of equipment are calculated by multiplying the time unit costs with the duration of certain operations. The time unit costs of equipment can be separated into machine time unit costs, software time unit costs and consumables time unit costs.

A general concept for calculation of the equipment costs of a piece of the equipment e during an activity a, (Ca-E-e), is to calculate the products of time unit costs of the used equipment (CTe) and duration of the activity (Ta), so Ca-E-e = CTe∙Ta. The calculations of the time unit costs differ for PBF machines, other machines, software, and consumables. In order to make an estimation of the equipment costs more realistic, it is important to assess the utilization ratio of the piece of the equipment e, defined as ue = Te/T, where Te represents the average occupancy time (sum of the setup time and the working time) of the piece of the equipment within the selected interval T (which may be day, week, month or a year).

Machine time unit costs

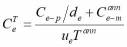

All the machines have finite operating life, and if the depreciation period of a piece of the equipment e is de years, then its time unit cost may be estimated as

with Ce-p representing the purchase cost, and Canne-m representing the annual maintenance costs, of the piece of equipment, while Tann represents duration of one year. The previous equation may be applied to the purchased PBF machines, blasting cabinet or an air compressor (e = PBF, proc, cab, comp). Considering the relatively small purchase costs and long deprecation times, as well as the lack of the maintenance costs, the equipment costs for computers used as the PC workstations may be neglected.

with Ce-p representing the purchase cost, and Canne-m representing the annual maintenance costs, of the piece of equipment, while Tann represents duration of one year. The previous equation may be applied to the purchased PBF machines, blasting cabinet or an air compressor (e = PBF, proc, cab, comp). Considering the relatively small purchase costs and long deprecation times, as well as the lack of the maintenance costs, the equipment costs for computers used as the PC workstations may be neglected.

However, since the additive manufacturing technologies develop fast, their obsolescence time may be considerably shorter than their operating life, and many companies opt for leasing of additive manufacturing machines. In such a case, the costs of the leased PBF machines should be estimated as

Software time unit costs

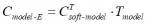

Software time unit costs, on the other hand, depend on the number of licenses that limit sharing of a software tool between different tasks, so that for the software for modeling and for batch assembly holds (e=soft-model and soft-ass)

with Ne-lic representing the purchased number of licenses for the software.

with Ne-lic representing the purchased number of licenses for the software.

Consumables time unit costs

Consumables (like air filters fusing lamps, print heads, cleaning rolls etc.) in practice do not have depreciation period, and the time unit cost of the consumable cons-k for the piece of the equipment e may be estimated as

where C1cons-k represents cost of purchase of a unit of the consumable, and nanncons-k represents the annual consumption of the consumable cons-k.

where C1cons-k represents cost of purchase of a unit of the consumable, and nanncons-k represents the annual consumption of the consumable cons-k.

Equipment costs of activities

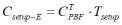

With these estimations of the time unit costs, the equipment costs of modeling, assembly, setup and removal may be calculated as

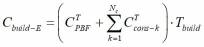

While the building activity requires only the production machine, its proper work requires various consumables, and if the number of the consumables is Nc, then the equipment cost of the building activity is

While the building activity requires only the production machine, its proper work requires various consumables, and if the number of the consumables is Nc, then the equipment cost of the building activity is

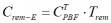

The blasting activity requires a blasting cabinet and an air compressor, but the equipment costs of the compressor should be shared between its users, in a manner similar to the sharing of the energy costs of the air compressor. Therefore, the equipment cost of the blasting activity is:

The blasting activity requires a blasting cabinet and an air compressor, but the equipment costs of the compressor should be shared between its users, in a manner similar to the sharing of the energy costs of the air compressor. Therefore, the equipment cost of the blasting activity is:

Overhead costs

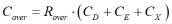

From the point of view of estimation of the production costs of PBF technology, the overheads comprise all the costs that are not related to the production process, but which are needed to enable and support it. A major part of the overheads represent the business costs such as administrative and management costs, renting or purchase of rooms, heating, lighting and water supply costs. As described, overhead costs are indirect costs that do not vary with level of production, and they exist even without production. One of the most used methods for estimation of the overhead costs is application of the fixed overhead rate RO to the other costs connected to a business process,

spreading the overhead costs over various production processes of a company. The overhead rates may be constant or determined using more complex costs drivers such as process duration or material consumption, but methodologies of sharing of the overhead costs between the products and services of a company are beyond the scope of this webpage.

spreading the overhead costs over various production processes of a company. The overhead rates may be constant or determined using more complex costs drivers such as process duration or material consumption, but methodologies of sharing of the overhead costs between the products and services of a company are beyond the scope of this webpage.

Other indirect costs

There are PBF technology costs that cannot be attributed to a specific production batch, such as transport costs, the health and safety costs (including waste disposal), material and product handling and similar costs. Unlike overheads, these costs do not arise without production process, but similar to the overheads, they are needed to enable and support the production.

Since the indirect costs from this category do not arise due to an individual production batch or due to a specific production activity in the event-driven-chain methodology, they have to be assigned to the individual production batches using some cost drivers, and the duration of the activities in the event-driven-chain of the PBF technology seem as a rational choice. As the activities overlap in time, the sum of their durations does not represent the total duration of production process, and it is better to use the building time as the cost driver for estimation of the other indirect costs attributed to a single production batch. Therefore, the indirect cost of type X-k assigned to a production batch, CX-k, may be estimated as

where CperX-k represents the indirect cost of the type X-k during a period with duration Tperk (usually a week, a month or a year), for which the indirect cost is known. The amount of the other indirect costs attributed to a single production batch is then

where CperX-k represents the indirect cost of the type X-k during a period with duration Tperk (usually a week, a month or a year), for which the indirect cost is known. The amount of the other indirect costs attributed to a single production batch is then

The cost assigned to an individual product (in a batch)

The aim of the developed model is to serve as a basis for development of algorithms for calculation of the production costs and, eventually, quoting. It should be therefore noted that, while the presented calculation of the production costs of a batch is reasonably accurate and well-funded, it is still not sufficient for the purposes of quotation. Namely, managements of companies are interested in estimations of production costs of individual products, even if the accuracy is lower than the accuracy of calculation of production costs of batches. The estimation of the costs of the individual products in a batch is based on the following reasoning:

- the sum of the costs of all products in a batch is equal to the cost of the batch;

- the costs of modeling are divided equally between the types of the products because the handling of the models is performed once for each type;

- the overheads are also divided equally between the types of the products as overheads do not depend on production volume (i.e. number of products);

- the costs of assembling into batch, setup of the production and removal of a certain type of the products are proportional to the number of the products of that type in the batch nk, because these activities require individual handling of each product;

- the other indirect cost are also proportional to the number of the products of a certain type in the batch nk, because the other indirect costs are affected by the production volume (i.e. number of products);

- the building costs are roughly proportional to the volume of the products; the reason is that these costs are driven by material costs and equipment costs; the material costs are determined by the volume of products, and the equipment costs are determined by the building time; since the building time increases with the height of a batch (due to the increase of the number of layers), the orientation of a product in a batch may be of crucial importance for its contribution to the production time17; nevertheless, an increase of the volume of a product also means increase of the fusion time for its production and thus increase of the building time of the batch; for these reasons, and for the sake of simplified estimation of product costs, is adopted the approximation of proportionality between the building costs and volume of products;

- the blasting costs are proportional to the surface of the products, because the duration of the blasting and the consumption of the abrasive increase with increase of the amount of the powder that remains attached to the product surface after removing from the product bin;

A batch generally consists of t types of products, and the number of k-th type of products will be denoted as nk (k = 1, 2,…, t), while the total number of products in the batch will be denoted as N, so that

and

and

where Vk and Sk (k = 1, 2,…, t) represent the volume and the surface of the k-the type of the products in the batch, which are calculated by 3D modeling and batch assembly software tools.

Further, the following weighting coefficients may to be calculated

where Vk and Sk (k = 1, 2,…, t) represent the volume and the surface of the k-the type of the products in the batch, which are calculated by 3D modeling and batch assembly software tools.

Further, the following weighting coefficients may to be calculated

- for number of the products of certain type k (k = 1, 2,…, t)

- for volumes of the products of certain type k (k = 1, 2,…, t)

- for surfaces of the products of certain type k (k = 1, 2,…, t)

Then, using the mentioned reasoning and the calculated weighting coefficients, the production cost of a single product of type k may be estimated as

Then, using the mentioned reasoning and the calculated weighting coefficients, the production cost of a single product of type k may be estimated as

Once again, it is important to stress that the cost assigned to the individual product is related to the production batch in which it is produced, and may not be used in any other context, or for any other production batch.